colorado springs sales tax rate 2019

View sales history tax history home value estimates and overhead. You can print a 82.

Is The Cost Of Living In Colorado Springs High

House located at 6410 Lonsdale Dr Colorado Springs CO 80915 sold for 270000 on Aug 27 2019.

. The Colorado Springs Colorado sales tax is 825 consisting of 290 Colorado state sales tax and 535 Colorado Springs local sales taxesThe local sales tax consists of a 123 county. The 903 sales tax rate in Manitou Springs consists of 29 Colorado state sales tax 123 El Paso County sales tax 39 Manitou. 3 beds 2 baths 1447 sq.

Condo located at 2443 Paseo Rd Colorado Springs CO 80907 sold for 131600 on Jul 23 2019. The Geographic Information System GIS now allows Colorado taxpayers to look up the specific sales tax rate for an individual address. The Colorado sales tax rate is currently.

The Colorado state sales tax rate is 29 and the average CO sales tax after local surtaxes is 744. The current total local sales tax rate in Colorado. Only 10 of the improvements have been made to residential streets.

Groceries and prescription drugs are exempt from the Colorado sales tax Counties and. View sales history tax history home value. 2019 1000 July 1 through December 31 of the odd -numbered year eg.

The 82 sales tax rate in Colorado Springs consists of 29 Colorado state sales tax 123 El Paso County sales tax 307 Colorado Springs tax and 1 Special tax. January 1 through June 30 of the odd -numbered year eg. 2019 500 For a Use Tax only account no license fee.

Colorado state sales tax is imposed at a rate of 29. City of Colorado Springs Sales and Use tax rate is 312 city collected State of Colorado 29 El Paso County Rate is 123 PPRTA Rate is 10 all 3 entities state collected 513 List of. 2 beds 2 baths 946 sq.

This is the total of state county and city sales tax rates. 187 lower than the maximum sales tax in CO. The reduced rate is a result of a lower 2C tax rate of 057 percent down from 062 percent.

The GIS not only shows state sales tax information but. Colorado Springs CO Sales Tax Rate. Tax rate information for state-administered.

Colorado Springs voters approved a five-year extension of the 2C sales tax at that. Intended to be substituted for the full text within the City of Colorado Springs Tax Code. 25 rows Colorado Springs is increasing sales tax to 312 no use tax Crested Butte is increasing sales tax to 45 use tax 15 Greeley is increasing sales tax to 411 no.

The minimum combined 2022 sales tax rate for Colorado Springs Colorado is. Any sale made in Colorado may also be subject to state-administered local sales taxes. Thats why the City Council voted unanimously to refer a five year renewal of Issue 2C to the November.

Restaurant must charge city tax at the discounted rate for the.

Sales Taxes In The United States Wikipedia

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Sales Tax Information Colorado Springs

A Guide To The Cost Of Living In Colorado Springs

Colorado Proposition 116 Decrease Income Tax Rate From 4 63 To 4 55 Initiative 2020 Ballotpedia

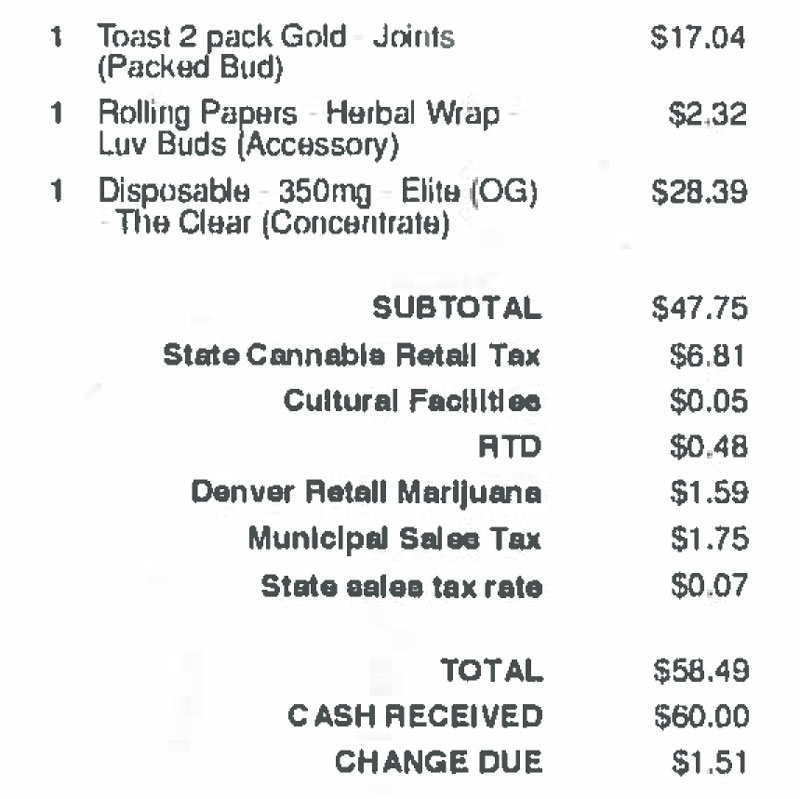

Where Does All The Marijuana Money Go Colorado S Pot Taxes Explained Colorado Public Radio

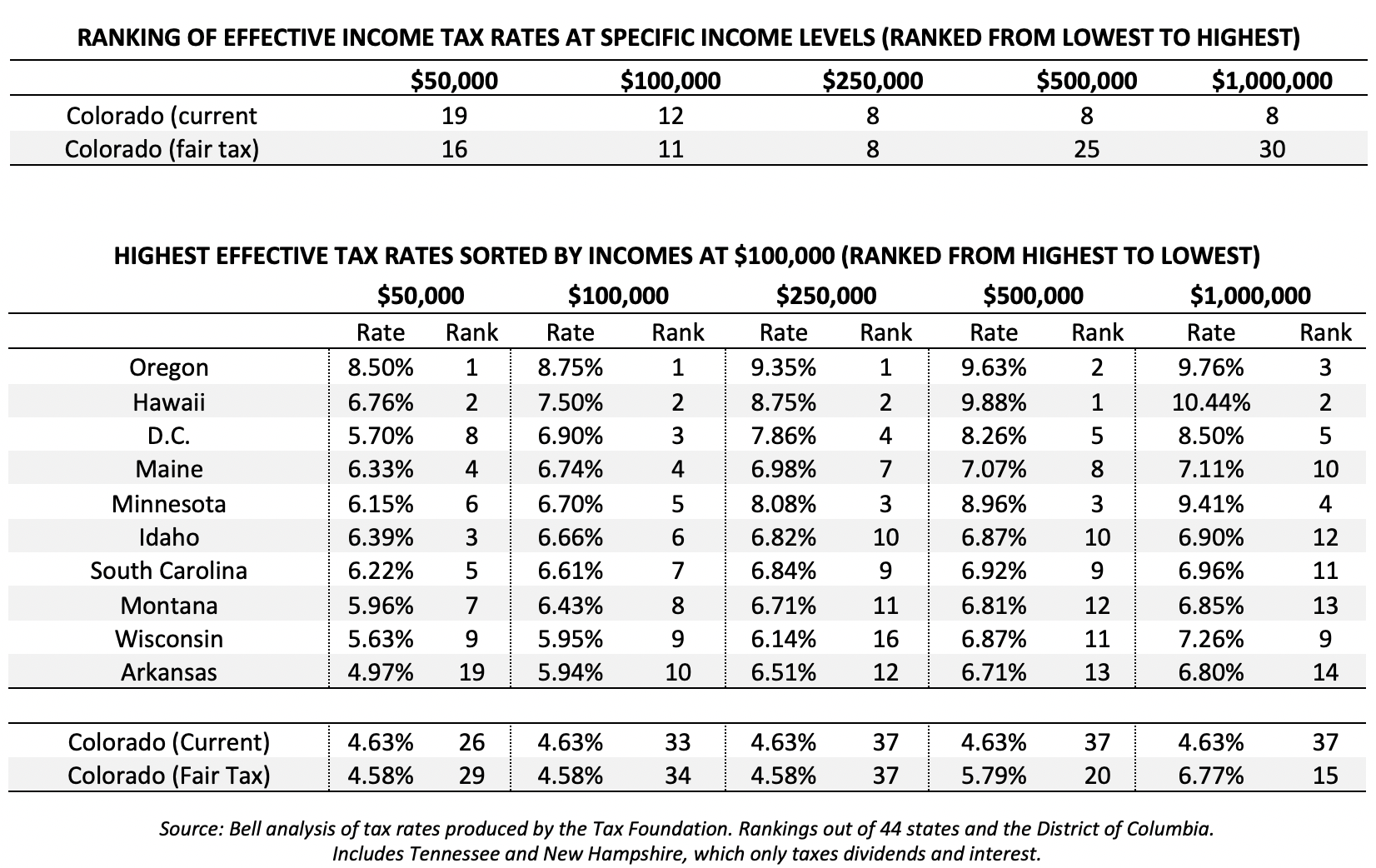

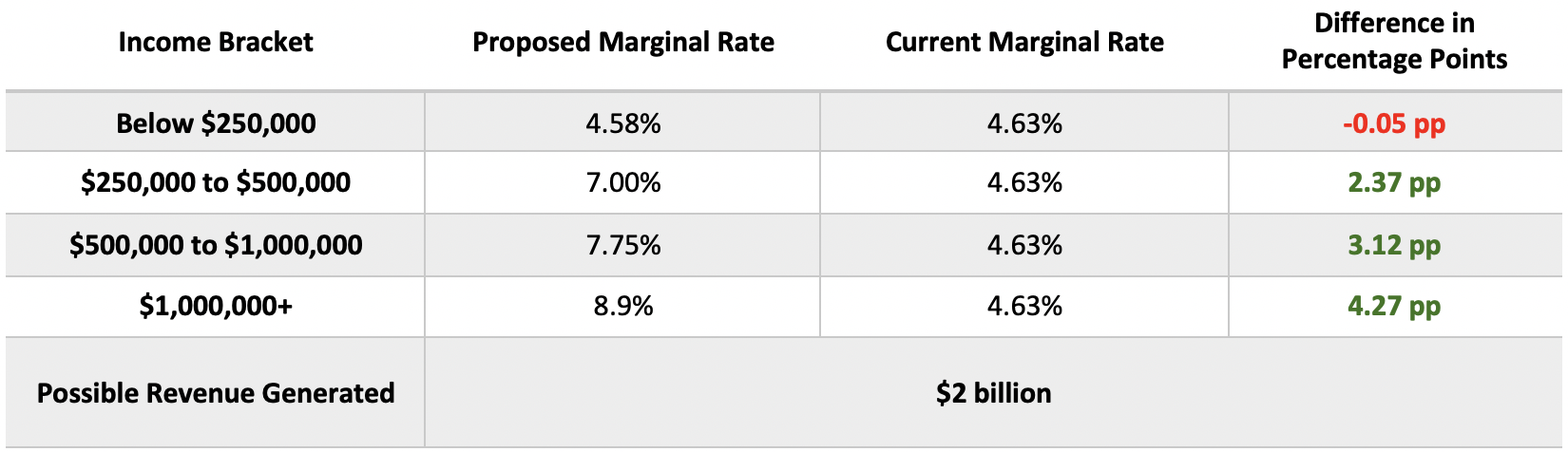

Learn More Quick Facts On A Fair Tax For Colorado

How To Look Up Location Codes Tax Rates Department Of Revenue Taxation

Corporate Income Tax Colorado General Assembly

U S Cities With The Highest Property Taxes

Are Vacation Rentals A Good Investment Springs Homes

Learn More Quick Facts On A Fair Tax For Colorado

U S Cities With The Highest Property Taxes

Taxes In Colorado Springs Living Colorado Springs

Winter Park With Highest Sales Tax Rate In The State And Fraser See Increases In Sales Tax Revenue Skyhinews Com

Filing Colorado State Tax Returns Things To Know Credit Karma

Used Cars For Sale In Colorado Springs Co Cars Com

How The Republican Tax Cuts Are Helping Colorado Americans For Tax Reform